Transactions always include debits and credits, and the debits and credits must always be equal for the transaction to balance. In accounting, account balances are adjusted by recording transactions. Examples of some income accounts include:Įxpenses decrease owners’ equity and therefore have a debit normal balance. You must credit an income account to record income. Income accounts increase owners’ equity on the balance sheet. Owners’ Equity accounts are located on the right side of the balance sheet and are thus increased by credits and decreased by debits. In Accounting, accounts can be identified in five categories. Basically, to understand when to use debit and credit, the account type must be identified. Liabilities are on the right side of the balance sheet and, therefore, are increased by credit and decreased by debits. Debit and credit account rules as per account types A above rules are also called as golden rules of accounting. The most common contra asset accounts are: Since they decrease assets, a contra asset account is increased with credits and decreased with debits.

#DEBIT CREDIT CASH FULL#

Think of these as individual buckets full of money representing each aspect of your company.

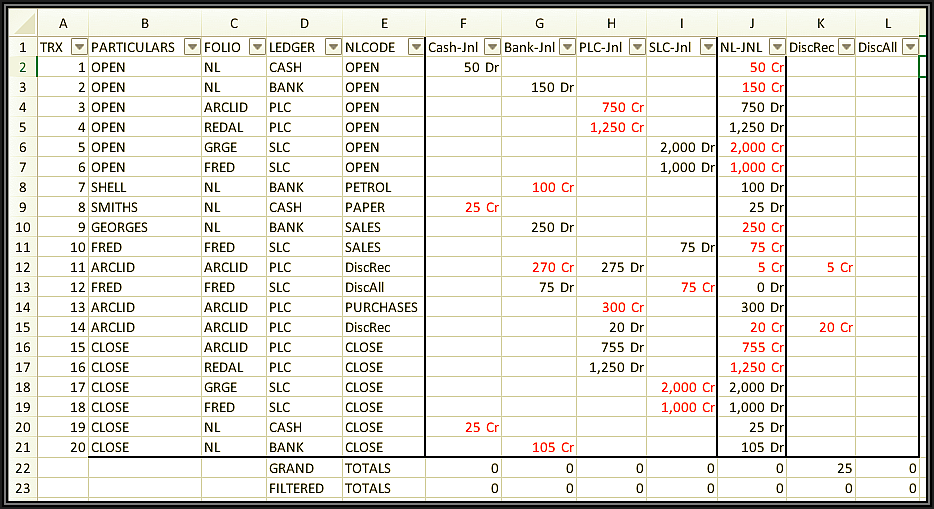

Under this system, your entire business is organized into individual accounts.

#DEBIT CREDIT CASH TRIAL#

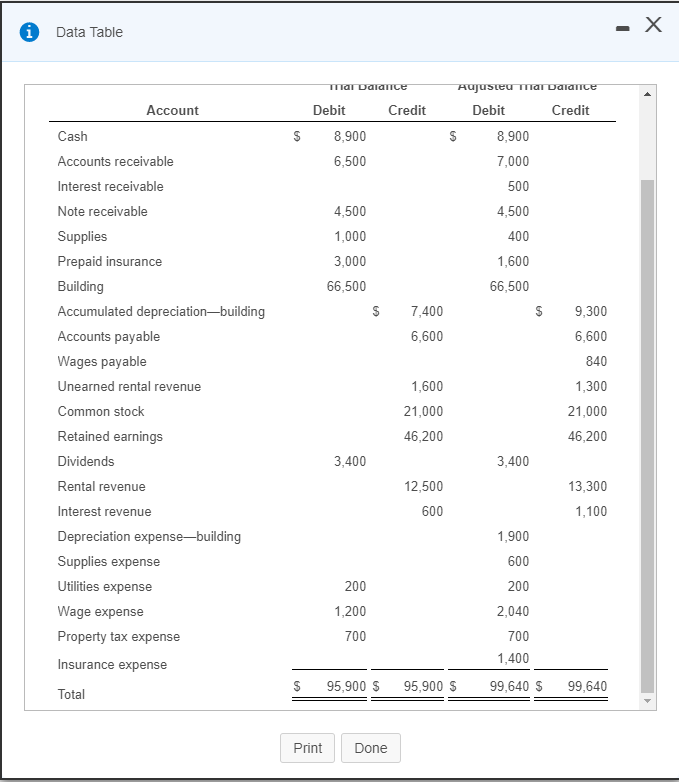

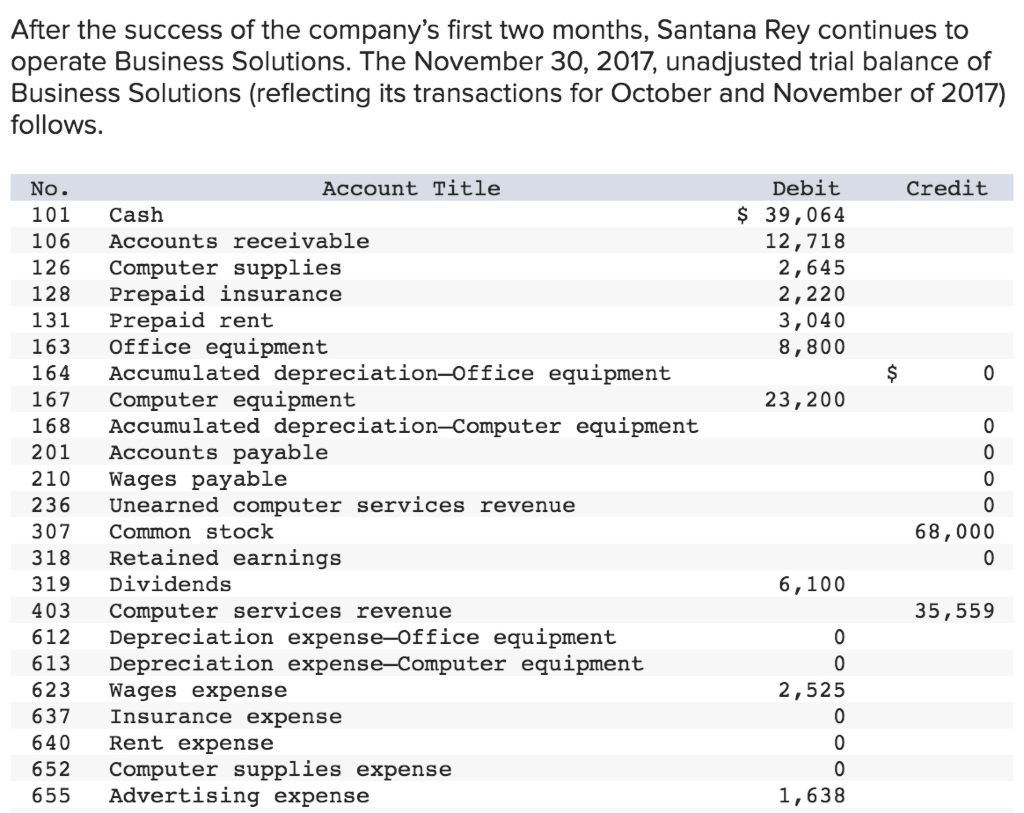

After adjusting entries are made, an adjusted trial balance can be prepared. Key Takeaways Adjusting entries are prepared at the end of the accounting period for: accrual of income, accrual of expenses, deferrals, prepayments, depreciation, and allowances. Since the increase in income and equity accounts is a credit, revenues will also be a credit entry. This income also impacts a company’s equity, increasing it when a company generates revenues. What does that mean Most businesses these days use the double-entry method for their accounting. Just like in the unadjusted trial balance, total debits and total credits should be equal. Is Revenue a debit or a credit Revenues represent a company’s income during an accounting period. As a liability on the right side of their balance sheet, the checking account is increased with a credit.Ĭontra asset accounts appear on the left side of the balance sheet along with assets, but they decrease the value of assets. What are debits and credits In a nutshell: debits (dr) record all of the money flowing into an account, while credits (cr) record all of the money flowing out of an account. A cashier or retail cashier is responsible for processing cash, debit, credit and check transaction using a cash register or other points sale system in a retail environment.their duties. From their viewpoint, your checking account is a liability because they owe that money to you. Q: If bank accounts are increased by debits, why does my checking account statement show deposits as credits?Ī: Your bank statement is from the point of view of your bank.

0 kommentar(er)

0 kommentar(er)